How a linguistic glitch tricks us into believing bank deposits are deposited in banks

Many people believe a 'bank deposit' is 'money I put into a bank'. But bank deposits are in fact money issued out by banks. In this piece I explain this linguistic confusion, and show you how it can prevent you from understanding 'fractional reserve banking'

Image Credit: Tebo Steele

After much consideration, I’ve decided to break one of my key rules when talking about money, which is:

‘Never use substance metaphors to talk about money’

I have this rule because, while it may be printed upon physical objects ('cash'), money is not a substance: it's not 'blood flowing through the veins of the economy', or whatever other substance metaphor you may wish to use.

But, in this instance, I’m going to break the rule and use the metaphor of water to show you that bank deposits are never deposited into banks.

Depositing water deposits

The glass pictured above stores liquids. If I take a jug of water and pour water into this glass, I'm depositing water into it. After I've done that, I might say there is a 'water deposit' in the glass.

Admittedly we don't often use that phrase to talk about water, but think for example of a geological metal deposit: in the beginning of the earth asteroids crashed and 'deposited' debris all over the planet, while volcanos 'deposited' lava, which nowadays leads us to discover 'cobalt deposits', ‘gold deposits’ or ‘iron ore deposits’.

Notice that the verb ‘deposit’ creates a noun of the same name: the exploding volcano 'deposits iron deposits', or the jug 'deposits a water deposit' into the glass.

Sign up to my newsletter!

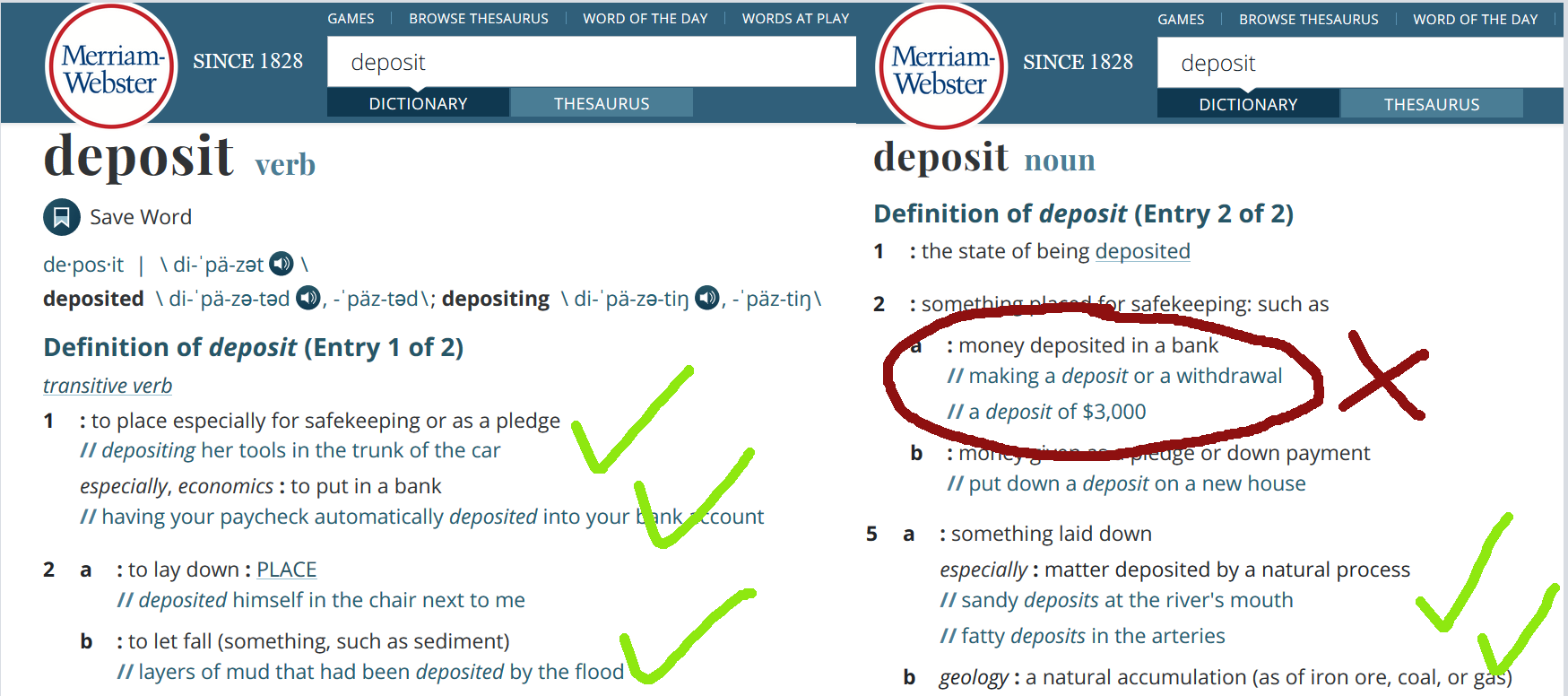

Following this linguistic convention, then, we are prone to thinking that we 'deposit a bank deposit'. Surely - much like the water we have poured into the glass - 'bank deposit' refers to money we have 'poured into’ the bank. Indeed, that's what reputable sources like the Merriam-Webster Dictionary say: according to them, a bank 'deposit' is 'money deposited in a bank'.

But they are totally wrong.

Unhitch the Linguistic Glitch

To understand 'bank deposits' you need to unhitch the verb from the noun. Let's illustrate this through the metaphor of a glass with water. If we imagine that the glass is the bank, the traditional mythology is that I pour (deposit) water (money) into it, after which the bank is 'storing' this 'deposit' for me. This is the mistake. The bank does not store my water for me. Rather they take ownership of my water - it is no longer mine - after which they issue me a promise for it. Imagine them taking out a piece of paper and writing ‘I owe you 100ml of water’. They hand it to me, issuing it out.

This promise they hand out to me is my 'deposit'.

So, as a noun, 'bank deposits' are not the 'thing put into banks'. They are the thing issued out by banks.

I illustrate this in this Youtube video by asking the viewer to imagine going into a casino with cash: you approach the cashier and hand the cash over in order to get casino chips. Those chips are a form of private currency that only works internal to the casino, and are issued out by the casino in response to money put in. Banks, similarly, issue out digital chips when we put in money. Those digital chips are the units we see 'in our bank account', but really our 'bank account' is just a record of what the bank has issued out to us. These outwardly-orientated digital chips are then called 'bank deposits' (or - sometimes - 'bank money', or M1), in contrast to the state money (or 'reserves', or M0), that gets 'put in'.

This article can also also be seen in YouTube form!

Confusingly, both the thing put in, and the thing issued out are called 'money' - if I 'pay by cash' I'm using state money, but if I 'pay by card' I'm using bank money, but in both scenarios I'll coloquially say 'I used money to pay'. To return to our water metaphor, this is like calling both water and a promise for water, 'water'). The accurate way to refer to 'paying by card' is to say 'paying by bank deposit transfer', which is the banking equivalent of using a casino chips to pay for something.

Promises for the treasure chest

I do not know the etymology of the noun 'bank deposit', but I'm guessing the confusion it creates emerges from a shortening of a term like 'deposit slip'. Imagine the following diary entry, perhaps coming from a 19th century merchant trying out a bank for the first time:

"Today I deposited all my state money into Barclays bank. The clerk issued me a deposit receipt, recognising that I had handed over ownership of my money to them, but promising me that I could come reclaim it. This slip - with its promise - is now my money."

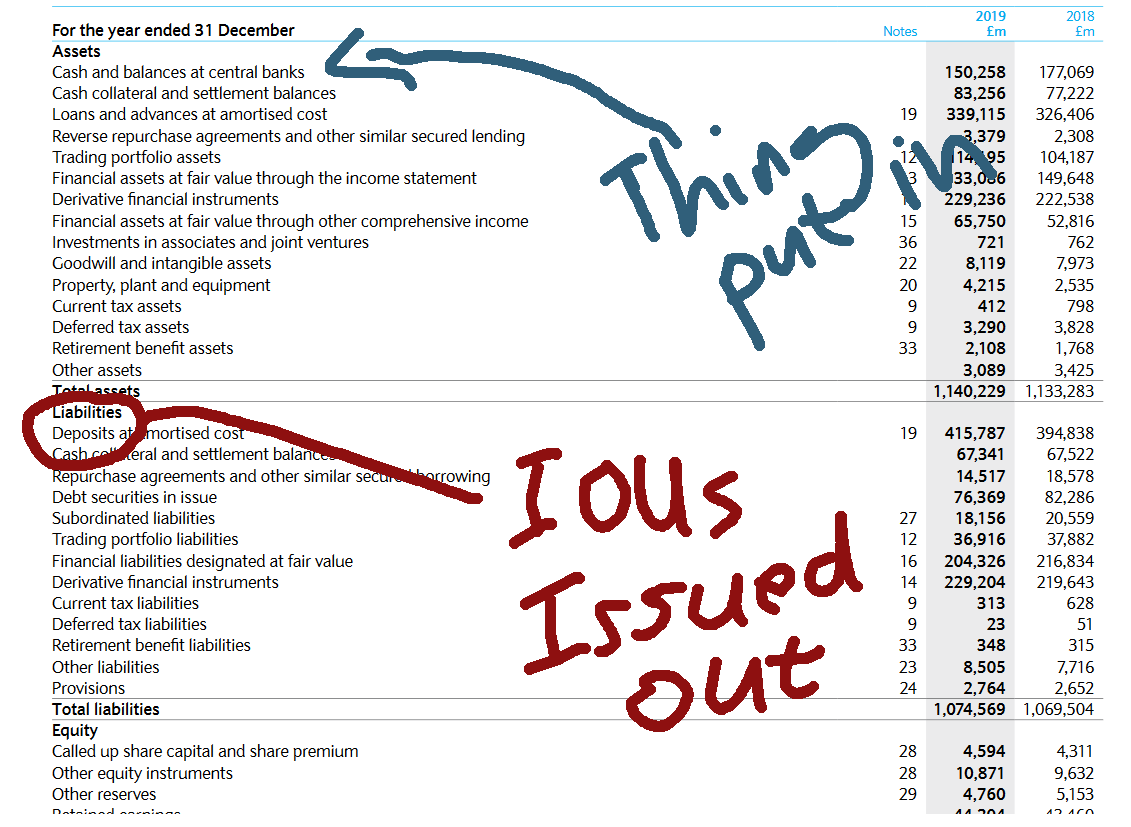

Nowadays these 'deposit receipts' are digital chips, and the 'receipt' part has been dropped, shortening the term to 'deposit'. This slippage has caused the verb and noun to diverge from their traditional English-language pairing, but the 'outward-facing receipt' nature of deposits is easily confirmed by looking at a bank balance sheet. Here's one from Barclays:

If deposits were ‘in’ the bank, they would be in the assets section on top. The assets section is like a record of the bank's ‘treasure chest’, with the things it owns. Notice, however, that 'deposits' are actually located in the liabilities section of the balance sheet, which records the promises that the bank has made (against the backdrop of the things it has in its 'treasure chest'), such as ‘we promise to pay you bondholders in two years’, or ‘we promise you state money on demand’. This latter promise is the ‘deposits’, and they are not ‘inside the glass’, because the glass is in the assets section.

Dispelling the deposit myth from 'fractional reserve'

But it gets better. Do you notice that 'deposits' on the liabilities side of Barclays balance sheet far exceed the 'cash and balances at central bank' category in their assets section? In our water metaphor, this means 'the promises for water we've issued out far exceeds the water in our glass'.

This is a result of what is sometimes called 'fractional reserve banking' (albeit I use the term 'credit creation of money')

Fractional reserve banking is a favourite bogeyman for bank critics to attack, but it's frequently misrepresented due to our misunderstanding about the nature of deposits. Let me explain.

If you start from the assumption that a deposit is a ‘thing inside the bank’, rather than a ‘thing issued out by the bank’, you will be prone to explaining fractional reserve banking as follows:

‘I deposit money into the bank, but they then secretly give it away to someone else whilst telling you it is still there’

If this is you, you've made an error, and have fallen into the trap of thinking that banks 'lend out the water that I've put inside them'. This also means you've failed to make a distinction between the two forms of money in our society: state money ('water'), and bank money ('promise for water'). And both of these misunderstandings are facilitated by the linguistic glitch we are trying to deprogram.

To accurately rewire your understanding, you must start from the recognition that your money ('bank deposits') is issued out by banks. The bank issues out promises for water in the glass, but - and this is crucial - they can issue out many more promises for water than they actually have. There is no process of them 'sneaking away water to give to someone else'. They don't touch the water. All they do is increase the number of promises they issue for it. Given that these bank promises are called deposits, it follows that deposits can be issued - and thereby expand - even if nothing was ‘deposited’.

But why would banks do that? Well, because they issue these short-term promises to extract more valuable long-term promises from the people they issue the short-term promises to. Those long-term promises end up in the assets section of the balance sheet, in that section called 'loans'. Yes, a loan is not 'water from the bank'. It is 'short-term promises for water from the bank, in exchange for long-term promises for water from you'.

Yes, banks can create assets by issuing liabilities, which is a more complex topic for another article, but if I had to adapt the water metaphor, I'd say something like 'when banks issue out excess promises for water in the glass, they conjur into being a portfolio of ghostly ice-statues that will attract melt-water towards the glass'...

That metaphor probably needs some work, but it's a good place to start.

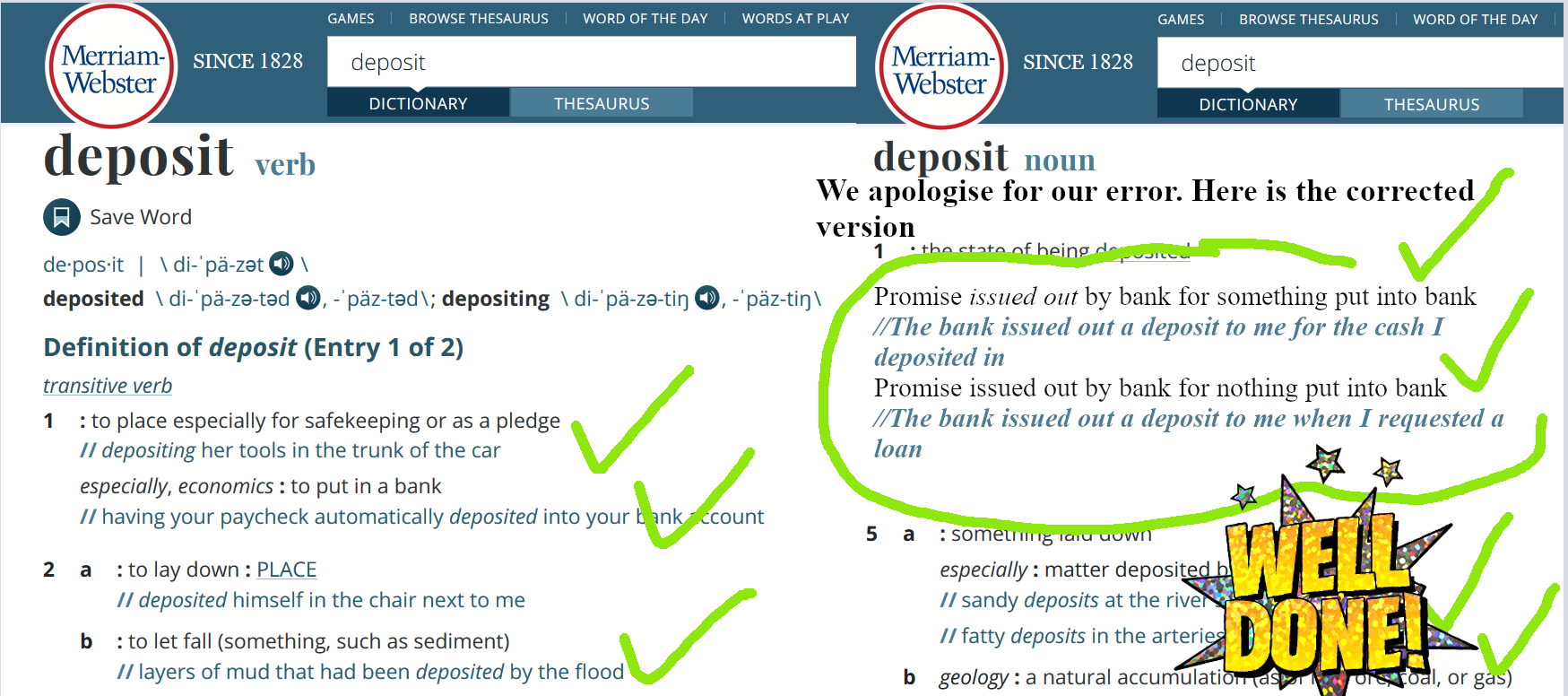

Update the dictionary

The verb-noun glitch creates all manner of weird anomalies when you start to play with it. For example, if I do indeed insist on 'depositing a bank deposit' it will in fact disappear, because - using our rewired understandings of those terms - that would actually mean 'handing back to the bank its own promises'. Incidentally, this is actually what happens when you 'repay a loan'. You are literally destroying bank money.

If that is too complex, don't worry. I'll make more articles and money mythbusting videos about this, with new metaphors.

I'll close, finally, with a suggestion for you Merriam-Webster, because I'm guessing you haven't updated this since 1828...

Do you have a comment or question?

In order to avoid the time-consuming job of dealing with the spambots and fraudsters who troll comments sections, I've decided to try something different. I have a read-only Google Doc of the article, where you are welcome to leave comments or questions. If I decide to integrate your suggestions into the piece, I will acknowledge your contribution. Alternatively, ping me on Twitter here.